Accepting cryptocurrencies as a form of payment offers numerous advantages for businesses. Not only does it help maintain competitiveness, but it also attracts a broader customer base and potentially reduces payment processing fees. This is especially beneficial for high-risk merchants who have encountered challenges with traditional payment processors.

It’s important to note that while these advantages exist, businesses should also consider the potential risks and volatility associated with cryptocurrencies.

Accepting Cryptocurrency Payments Can Provide Businesses With Several Advantages

- Global Accessibility: Cryptocurrency transactions are not bound by geographical limitations or currency exchange rates. By accepting crypto payments, businesses can tap into a global customer base, expanding their reach and potentially increasing sales.

- Lower Transaction Fees: Traditional payment methods often involve transaction fees, especially for cross-border payments. Cryptocurrency transactions typically have lower fees, which can be cost-effective for businesses, especially those with high transaction volumes.

- Increased Security: Cryptocurrency transactions rely on cryptographic technology, making them highly secure. The decentralized nature of blockchain technology used in cryptocurrencies enhances transaction integrity, protecting businesses and customers from fraud and unauthorized activities.

- Faster Settlements: Crypto transactions can offer faster settlement times compared to traditional banking systems. This benefit is particularly advantageous for businesses that deal with time-sensitive operations or require quick access to funds.

- Innovation and Forward-Thinking Image: Accepting cryptocurrency payments positions businesses as innovative and forward-thinking. It demonstrates an ability to adapt to emerging technologies and attracts tech-savvy customers who prefer using cryptocurrencies for their transactions.

Accepting Cryptocurrency Payments Can Provide Businesses With Some Risks

Volatility: Cryptocurrencies are known for their price volatility. The value of cryptocurrencies can fluctuate significantly within a short period.

This volatility poses a risk for businesses as they might receive payments in cryptocurrencies that could decrease in value before they are converted into traditional currency.

- Limited Adoption: Although cryptocurrencies have gained popularity, they still have relatively limited adoption compared to traditional payment methods. Not all customers are comfortable or familiar with using cryptocurrencies for transactions, which may limit the customer base for businesses that solely accept crypto payments.

- Regulatory Uncertainty: The regulatory environment surrounding cryptocurrencies is still evolving in many jurisdictions. Businesses accepting crypto payments may face uncertain legal and regulatory frameworks, which could result in compliance challenges or potential legal issues.

- Technical Complexity: Integrating and maintaining a crypto payment gateway requires technical expertise. Businesses may need to invest time and resources into understanding the intricacies of cryptocurrencies, implementing secure payment processes, and managing wallets and private keys.

- Security Risks: While cryptocurrencies offer inherent security features, they are not immune to security risks. Businesses accepting crypto payments may become targets for hacking attempts or phishing attacks aimed at stealing cryptocurrencies or compromising payment systems.

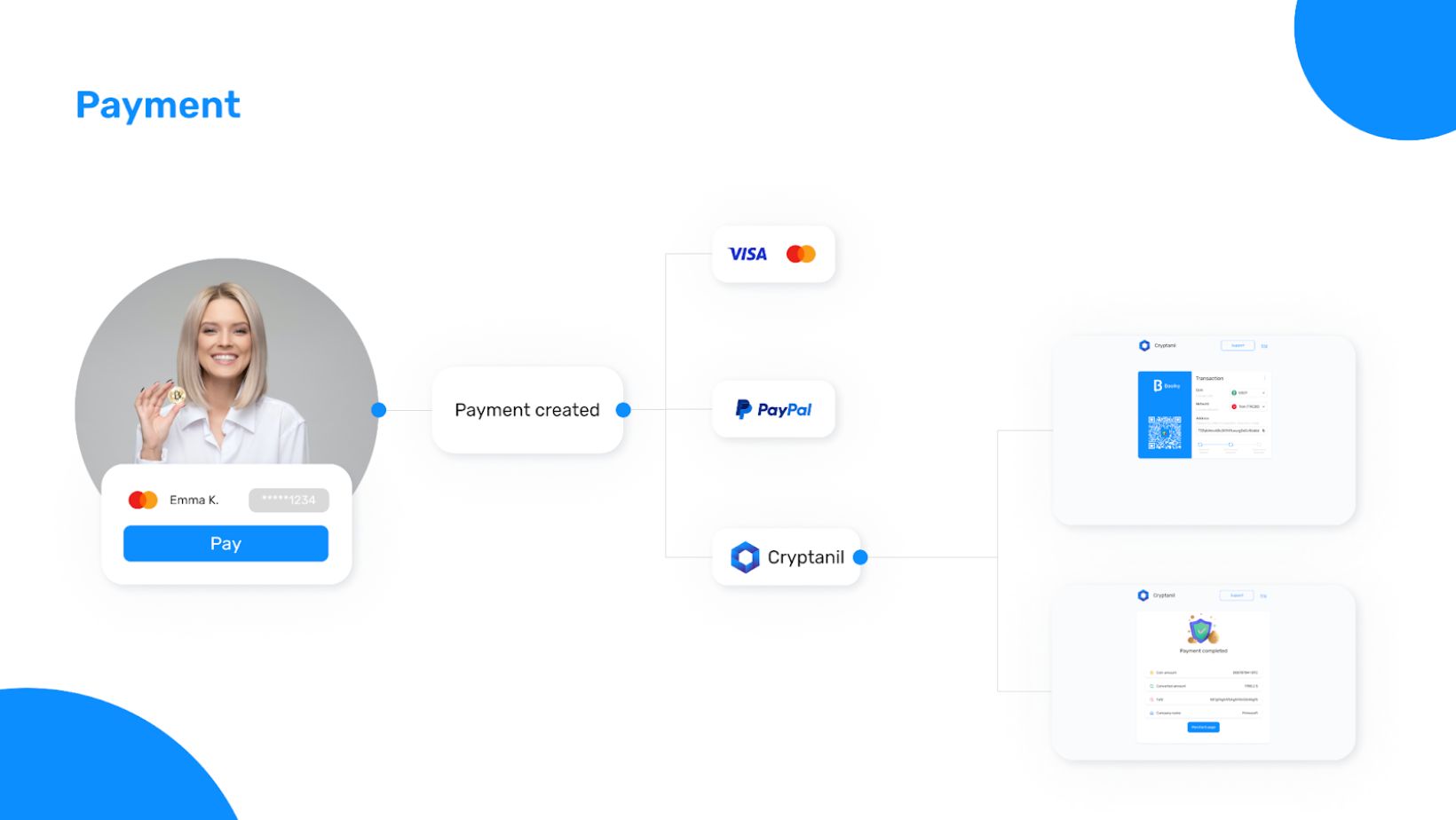

To Effectively Address These Risks, Crypto Payment Providers have Developed Solutions

- Volatility Mitigation: Crypto payment gateway providers offer the option to convert incoming transactions into stablecoins, which are linked to a specific currency and have lower volatility. This reduces the risk of asset devaluation and helps businesses manage volatility concerns. Also, white label payment gateway has a core set of standard features, including plugins, SDKs, recurring payments, routing, and, in some cases, invoicing. Such solution provides an easy plug-and-play architecture to start accepting payments in crypto. Merchants need to sign up for an account and integrate the payment API, and they are ready to process Bitcoin and Altcoin transactions.

- Regulatory Compliance: Most crypto payment gateways provide the functionality to convert cryptocurrencies into fiat currencies, allowing businesses to adhere to existing financial regulations and withdraw funds in traditional currencies.

- Technical Ease: Crypto payment gateways offer ready-to-use tools, such as REST APIs and CMS plugins, simplifying the technical complexities associated with implementing and interacting with blockchains. This allows businesses to focus on their core operations.

- Risk Management: Payment gateways assume responsibility for managing events related to blockchain transactions, alleviating businesses of potential risks associated with blockchain-related issues.

While these aspects are well-addressed, the primary challenge remains in the relatively low adoption of cryptocurrencies. However, this limited adoption is unlikely to cause significant harm to a company; instead, it can attract forward-thinking customers who value businesses embracing innovative payment methods.

In summary, accepting cryptocurrencies can be a beneficial step for businesses, provided they carefully weigh the advantages against the risks and choose a reliable crypto payment provider that addresses these concerns. By doing so, businesses can unlock new opportunities in the digital economy and stay at the forefront of technological advancements.