Despite the success of reaching global adoption, obstacles to bitcoin still remain with Latinx communities. Five years after its creation, there are still not enough places that accept or use cryptocurrency in general for it to be an effective tool in the hands of these marginalized groups.

The “latin american country bitcoin” is a cryptocurrency that has been rising in popularity. Latinx communities have continued to rise above the obstacles of adoption for this currency.

Digital assets have lately grown increasingly common in our everyday lives, including the news, popular culture, and personal relationships. The number of worldwide daily Bitcoin (BTC) transactions reached 367,536 in the first quarter of 2021. Bitcoin is currently responsible for around $20 billion in daily internet transactions. Furthermore, people who are acquainted with digital assets and cryptocurrencies have implicit faith in them — Binance’s “Global Crypto User Index” for 2021 indicates a 97 percent confidence in cryptocurrencies.

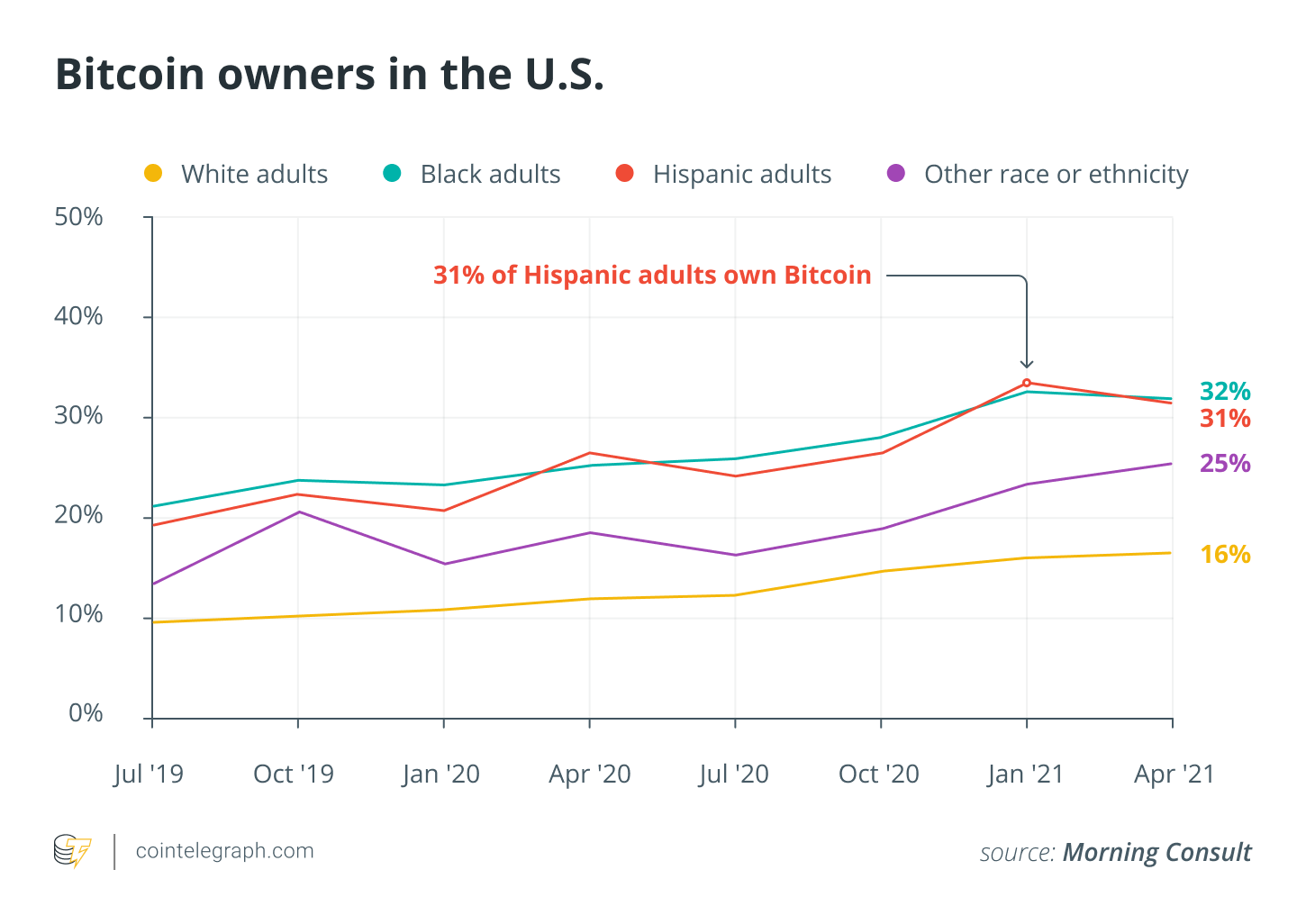

Latinx individuals in the United States have some of the highest rates of cryptocurrency adoption, with around 31% of Hispanic persons having Bitcoin and 25% of Bitcoin owners being Latinx, according to the same statistics. There are a number of factors that contribute to this high rate of adoption, not the least of which is the fact that this demographic has less conventional wealth. Latinx households had less than a sixth of the wealth of white families in 2016, and were many times more likely to support family members who did not live with them. Mexicans in the United States transferred more than $40 billion to family members in Mexico in 2020, with many of these payments taking place through bitcoin.

While Latinx communities appear to be at the forefront of adopting digital assets and using them to improve their daily lives, it is critical that those in the cryptocurrency and digital asset industries make efforts to include marginalized groups in their future plans, to integrate with and embrace these communities, and to ensure that everyone is aware of the wide range of benefits digital assets can provide.

Adoption in Latin America

It will only be a matter of time until digital assets are widely used across Latin America. Consider El Salvador’s decision to become the first government in the world to recognize Bitcoin as legal money. El Salvadoreans may now get $30 in Bitcoin when they download and register for Chivo, the government’s cryptocurrency program. Bitcoin may be used to pay taxes, and pricing will be listed in either BTC or USD. The rule was enacted in part to assist persons sending remittances back to El Salvador from other parts of the globe, since these transfers are often subject to significant transaction and commission costs when made in fiat currency.

What is the true motivation behind El Salvador’s ‘Bitcoin Law’? Experts respond.

Argentina is following El Salvador’s example, with members of Argentina’s National Congress recently introducing a law allowing Argentines to accept Bitcoin as payment for their salary. Cuba, Paraguay, and Uruguay have all said that bitcoin would be recognized and regulated in their nations in the near future. El Salvador’s social media actions have been praised by leaders from Argentina, Brazil, Panama, and other countries.

One example of how digital assets may empower individuals is assisting migrants who are sending remittances to their family and friends in their home nations. Bill payment systems based on blockchain technology might be life-changing for those living in underserved areas. Blockchain payments are more secure, quicker, and frequently less expensive than conventional methods, because they don’t need access to existing banking and payment systems. This is especially crucial since many people in underprivileged areas lack access to a bank account. Despite accounting for just 32% of the population, Black and Latinx families account for 64% of the unbanked and 47% of the underbanked in the United States.

Overcoming Entry Barriers

Those from underprivileged areas have shown their perseverance and resolve by innovating and using new technology to their advantage, surpassing the constraints imposed by conventional finance. These groups are among the most knowledgeable about cryptocurrency in the United States, and they are eager to accept and utilize it.

The crypto business, governments, and organizations must now go out to disenfranchised people and cater to them particularly, integrating with their communities, and teaching them how they may profit and improve their daily lives. If businesses and regulatory authorities can learn about these groups’ customs and traditions, they will be able to comprehend their demands and accommodate them in a mutually beneficial manner.

Two major roadblocks to digital asset adoption remain: a lack of awareness and security concerns. To this aim, individuals must grasp the value of digital assets and how they may benefit themselves and their communities via education. Fear and a lack of knowledge are understandable given that digital assets are still a relatively new notion. It’s hard to see how these new technologies can replace long-standing entities like conventional banks, and how they can better serve them in terms of effectiveness, safety, and security.

Related: Blockchain technology can be widely used, and education is the key.

Blockchain technology is used in digital assets, and it is widely regarded as one of the most secure solutions for transactions and payments. However, this may not be obvious to individuals inexperienced with the idea and worried about the security of their money and payments. We can assist cryptocurrency users pick safe, regulated, and licensed digital asset providers with the necessary knowledge and educational programs, so they can trade with confidence.

Crypto adoption is still in its infancy, and there are several roadblocks to overcome. In many nations, strong government links to conventional banking will fuel distrust about digital assets. Taking a top-down approach, governments and business leaders must support this cutting-edge, enormously useful technology. We can further empower and alter individuals’ lives by fostering a secure, regulated environment for crypto and enabling healthy dialogue and education on the issue.

There is no financial advice or suggestion in this article. Every investing and trading choice has risk, and readers should do their own due diligence before making a decision.

The author’s views, ideas, and opinions are entirely his or her own, and do not necessarily reflect or represent those of Cointelegraph.

Rodrigo Bezanilla is Coinsource’s Latin American business strategist. Rodrigo has vast expertise in cross-border connections between Mexico and the United States, having worked as an investment and financial consultant for over 25 years. Rodrigo devotes his skills to generating possibilities for the Latin American community via strategic corporate partnerships and private equity operations as managing partner of the Tejas Opportunity Group, a cross-border private equity company focusing on social impact investments in Texas.

The “central america bitcoin” is a cryptocurrency that has been rising in popularity. Latinx communities are helping to lead the way for Bitcoin adoption.

Related Tags

- bitcoin news latin america

- south american countries adopting bitcoin

- bitcoin legal tender paraguay

- crypto in south america

- el salvador bitcoin legal tender